Welcome to the Ultimate Guide to Buying a Home in Ohio!

Whether navigating the real estate market as a first-time homebuyer or a seasoned homebuyer, our comprehensive guide to buying a home in Ohio will streamline your process, providing the insights and tools you need to make informed decisions. From securing financing to moving into your dream home, we’re here to support you at every step, ensuring your home-buying experience in Columbus is as smooth and enjoyable as possible.

In this Ultimate Guide to Buying a Home in Ohio, we’ll cover:

Expand for more details & quick links

Why Columbus?

Discover why Columbus is an ideal place to call home, from its robust job market and excellent schools to its rich cultural amenities and diverse neighborhoods. Jump to this section.

The Home Buying Process

Learn the essential steps in the home-buying journey, including financial planning, mortgage pre-approval, and working with a real estate agent. Jump to this section.

Financing Your Columbus Home

Explore your mortgage options and get tips on securing the best financing to fit your budget and goals. Jump to this section.

Making an Offer and Negotiating

Find out how to craft a competitive offer and navigate negotiations to achieve the best possible outcome. Jump to this section.

Home Inspections

Understand the importance of thorough inspections and appraisals to ensure your new home is a wise investment. Jump to this section.

Appraisals

Understand the how appraisals work and why they are important to buying a home in Ohio. Jump to this section.

Closing On Your Home

Get prepared for the final steps of the home-buying process, from understanding closing costs to signing the necessary documents. Jump to this section.

Moving Into Your New Home in Columbus

Enjoy practical advice for a smooth move and tips on getting settled in your new community. Jump to this section.

Frequently Asked Questions

Find answers to common questions about buying a home in Columbus, Ohio. Jump to this section.

Each section of this guide is designed to assist you through the home-buying process, making it as straightforward and enjoyable as possible. Columbus is a wonderful place to live, and buying a home in Ohio is an investment in your future. Let’s embark on this journey together, towards finding your Ohio dream home.

Why Columbus, Ohio?

Columbus, Ohio, is more than just the state capital; it’s a thriving hub of culture, education, and economic growth. With vibrant neighborhoods, excellent schools, and a strong job market, Columbus is an ideal place for families, professionals, and retirees alike. Buying a home here means investing in a community rich in history and optimism for the future. Don’t just take our word for it, even major corporations are investing in the allure of Columbus.

Recent Corporate Investments in Columbus

John Glenn Columbus International Airport Expansion: The $2 billion terminal project at John Glenn Columbus International Airport will add seven new gates and improve infrastructure, boosting connectivity and attracting more airlines and routes. This expansion is expected to drive local economic growth, create job opportunities, and enhance the overall quality of life for residents by making travel more convenient.

Intel’s New Chip Factory: Intel’s $20 billion investment in a new semiconductor manufacturing facility in Licking County, near Columbus, is set to create over 7,000 construction jobs and significant economic opportunities. This project will boost the local economy, enhance real estate demand, and establish Columbus as a key player in high-tech manufacturing.

Honda EV Hub: Honda’s establishment of an Electric Vehicle (EV) Hub in Marysville, Ohio, involves a $700 million investment and the creation of 300 jobs. This hub will focus on EV production and sustainability, further solidifying Columbus’s position as a leader in innovative automotive manufacturing.

These major corporate investments highlight Columbus’s dynamic growth and the myriad opportunities available to residents. The city’s commitment to economic development, coupled with its vibrant community and excellent quality of life, makes Columbus an attractive place to call home.

Columbus Ohio School Districts and Education

Columbus, Ohio, is central to several surrounding public school districts, each with its own unique characteristics and strengths. Review the key school districts and whether they meet your needs before buying a home in Ohio. We’ve compiled the data and listed some of the school districts in this area for you.

In addition to public schools, Columbus offers a variety of private and charter school options for families seeking alternative educational environments:

Private Schools: Columbus is home to several prestigious private schools, including The Wellington School, Columbus Academy, and St. Charles Preparatory School. These institutions often provide smaller class sizes, individualized attention, and specialized programs.

Charter Schools: Charter schools in Columbus, such as the Columbus Collegiate Academy and KIPP Columbus, offer innovative educational models and unique curricula. These schools are publicly funded but operate independently of the traditional public school system.

Higher Education Opportunities

Columbus is also a hub for higher education, with numerous colleges and universities offering a wide range of programs:

Otterbein University

Located in nearby Westerville, Otterbein is known for its innovative approach to education, including integrative studies and community engagement.

The Ohio State University

As one of the largest universities in the country, Ohio State offers a comprehensive array of undergraduate, graduate, and professional programs. The university is renowned for its research initiatives and vibrant campus life. Go Buckeyes!

Columbus State Community College

Columbus State provides affordable education options, including associate degrees, certificate programs, and transfer pathways to four-year institutions. The college focuses on workforce development and community partnerships.

Capital University

A private liberal arts university, Capital University offers a variety of undergraduate and graduate programs with a strong emphasis on personalized education and experiential learning.

Of course, our team is always available if you should have additional questions. We enjoy speaking with potential home buyers and clients. We know how stressful home buying can be and we understand the need to get all the answers so you can make an informed decision about where you should be buying a home in Ohio.

Living in Columbus Ohio: Lifestyle and Amenities

Columbus, Ohio, is a city rich in culture, history, and modern amenities. From its diverse neighborhoods and vibrant arts scene to its plethora of parks and recreational activities, Columbus offers a quality of life that appeals to people of all ages and lifestyles. Here’s a sampling of the lifestyle and amenities you can expect when living in Columbus.

Buying a Home in Ohio ‘s Diverse and Vibrant Neighborhoods

Columbus Ohio is home to a variety of neighborhoods, each with its own unique character and charm. The historic neighborhood of German Village is famous for its beautifully restored brick houses and charming streets. It’s a cultural hub with a mix of quaint shops, bakeries, and top-rated restaurants like Schmidt’s Sausage Haus. Known for its vibrant arts scene, the Short North is filled with galleries, boutiques, and some of the city’s best restaurants and nightlife spots. The Arena District is a lively area home to Nationwide Arena and Huntington Park, offering a mix of entertainment, dining, and nightlife options. It’s a popular spot for sports fans and concert-goers.

Explore these and other suburban neighborhoods on our communities page.

Ohio’s Parks and Outdoor Activities

Columbus Ohio offers an abundance of parks and outdoor activities, making it easy to enjoy nature and stay active. A sampling of the wonderful parks offered in central Ohio includes the Scioto Mile, an urban oasis along the Scioto River featuring miles of multi-use trails, beautiful parkland, and stunning city views. It’s perfect for walking, biking, and enjoying outdoor events. The Franklin Park Conservatory and Botanical Gardens is a horticultural and educational institution that offers beautiful gardens, art exhibitions, and family-friendly events throughout the year. In Clintonville, the Columbus Park of Roses is one of the largest public rose gardens in the U.S., offering a serene setting for picnics, walks, and appreciating the beauty of their over 12,000 roses. There are 19 metro parks offering hiking trails, activities, scenic overlooks, and opportunities for Ohio wildlife viewing.

Arts and Culture in Ohio

Columbus has a thriving arts and culture scene, with numerous venues and events that cater to a wide range of interests. The Columbus Museum of Art is known for its impressive collection of American and European modern art, and also hosts rotating exhibitions and educational programs. Located at The Ohio State University, the Wexner Center features contemporary art exhibitions, performances, and film screenings. A historic landmark, the Ohio Theatre hosts Broadway shows, concerts, and performances by the Columbus Symphony Orchestra. COSI is a family favorite because it’s a dynamic hands-on science center that’s fun for all ages, and offers interactive exhibits and educational programs.

Columbus Ohio Dining and Shopping

Columbus is a foodie haven with a diverse array of dining options and shopping experiences. As a matter of fact many chains choose Columbus as the location to test public response to new dishes and services first. Don’t miss our Farmer’s Markets, the Brewery District, Easton Town Center or Polaris Fashion Place.

Ohio Sports and Recreation in Columbus

Columbus is a sports lover’s paradise, with plenty of opportunities to watch and participate in sporting events. The city’s NHL team, Columbus Blue Jackets, play at Nationwide Arena, offering exciting hockey games for fans to enjoy. Columbus Crew, a Major League Soccer team, plays at Lower.com Field, providing thrilling soccer matches and a passionate fan base. The city’s Triple-A baseball team, Columbus Clippers, play at Huntington Park, offering family-friendly entertainment and a great ballpark experience. And, of course, we must mention the Ohio State Buckeyes, a college sports powerhouse plus Ohio State University offers a range of sports events, from football and basketball to gymnastics and swimming.

By offering a blend of vibrant neighborhoods, abundant parks, rich cultural experiences, diverse dining and shopping options, and exciting sports activities, Columbus provides a high quality of life that appeals to residents of all ages. Whether you’re a young professional, part of a growing family, or a retiree, Columbus, Ohio, has something to offer everyone.

The Process of Buying a Home in Ohio

Buying a home in Ohio is always an exciting journey but it requires careful planning for smooth execution. While many people begin by exploring listings and visiting open houses, the process truly starts by securing financing and partnering with a knowledgeable REALTOR who can guide you through each step.

1. Finding the Right REALTOR

Choosing the best REALTOR for your needs is what sets you up for a successful home-buying experience. A skilled REALTOR not only helps you find the perfect home but also acts as your advocate throughout the homebuying process. Here are key qualities and questions to consider when selecting a REALTOR:

- Experience and Knowledge: Look for a REALTOR with extensive experience in the Columbus market. They should have a deep understanding of local neighborhoods, market trends, and community amenities.

- Communication Skills: Your REALTOR should be a good listener and communicator, keeping you informed at every stage and responding promptly to your questions and concerns.

- Client Testimonials: Check reviews and testimonials from past clients to gauge their satisfaction with the REALTOR’s services.

Questions to Ask Potential REALTORS when Buying a Home in Ohio:

- How will you keep me informed throughout the process?

- How long have you been working in real estate, specifically in Columbus?

- Can you provide references from recent clients?

- How familiar are you with the neighborhoods I’m interested in?

- What is your approach to helping clients find the right home?

Read more Questions to Ask When Buying a House.

2. Initial Consultation with Your REALTOR

Once you’ve chosen a REALTOR, the journey begins with an initial consultation. During this meeting, your REALTOR will ask a series of questions to understand your needs, preferences, and financial situation. This information helps them tailor their search to find homes that best match your criteria.

Common Questions REALTORS May Ask:

- What is your budget range for purchasing a home?

- Are you pre-approved for a mortgage? If not, would you like assistance with the pre-approval process?

- What type of home are you looking for (e.g., single-family, townhouse, condo)?

- How many bedrooms and bathrooms do you need?

- Are there specific neighborhoods or school districts you prefer?

- What are your must-have features (e.g., garage, backyard, modern kitchen)?

- Do you have any preferred home styles (e.g., ranch, colonial, contemporary)?

- Are there any deal-breakers that would prevent you from considering a particular home?

3. The Importance of Mortgage Pre-Approval

While it’s tempting to start by looking at homes, securing financing is the critical first step. Mortgage pre-approval gives you a clear understanding of your budget and shows sellers that you are a serious buyer. It also allows you to act quickly when you find the right home, which is essential in a competitive market like Columbus.

Benefits of Mortgage Pre-Approval:

- Budget Clarity: Know exactly how much you can afford, preventing you from wasting time on homes outside your price range.

- Strengthened Offers: Pre-approval letters demonstrate to sellers that you are financially ready to buy, making your offers more attractive.

- Faster Closing: With pre-approval in hand, the closing process can move more swiftly and smoothly.

Next Steps to buying a home in Ohio:

- Gather necessary financial documents, such as pay stubs, tax returns, and bank statements.

- Research and contact reputable lenders to start the pre-approval process.

- Work with your REALTOR to refine your home search based on your pre-approval amount.

By starting with these foundational steps—choosing the right REALTOR and securing mortgage pre-approval—you’ll be well-prepared to embark on your home-buying journey in Ohio. These steps ensure you have the guidance, support, and financial clarity needed to make informed decisions and successfully navigate the market.

Financing Your Ohio Home

When buying a home in Ohio, securing financing is a crucial first step. Here’s a quick overview to help you get started:

- Explore Mortgage Options: Familiarize yourself with common types of mortgages, including Conventional Loans, FHA Loans, VA Loans, and USDA Loans. Each type has different requirements and benefits depending on your financial situation and homeownership goals.

- Choose the Right Lender: Research and compare lenders based on interest rates, loan terms, and fees. Get recommendations from trusted sources and go through the pre-approval process with a few lenders to find the best deal.

- Understand Mortgage Rates and Terms: Know the difference between fixed-rate and adjustable-rate mortgages (ARMs), and consider the impact of loan terms (e.g., 15, 20, or 30 years) on your monthly payments and overall loan cost.

- Calculate Upfront Costs: Be aware of down payments and closing costs. A higher down payment can lower your monthly payments and eliminate private mortgage insurance (PMI), while closing costs generally range from 2% to 5% of the loan amount.

For a more detailed guide on financing your Ohio home, including additional tips and insights, read our full article on Financing Your Columbus home.

By understanding your mortgage options, choosing the right lender, and securing pre-approval, you’ll be well-prepared to finance your home. These steps ensure you have the financial clarity and confidence needed to make informed decisions when buying a home in Ohio while helping you to secure your dream home.

Making an Offer and Negotiating when Buying a Home in Ohio

Once you find your dream home, the next critical step to buying a home in Ohio is making an offer. This section of the Ultimate Guide provides strategies for crafting a competitive offer, understanding the importance of earnest money, and navigating the negotiation process to achieve the best possible outcome. It’s more than just deciding on a price; it’s about crafting a competitive offer that considers the seller’s needs while protecting your own interests. Here’s a guide to help you navigate making an offer and negotiating the best possible terms when buying a home in Ohio:

1. Crafting a Competitive Offer

When making an offer, several factors must be considered to ensure it stands out in a competitive market. Here are key components to include:

- Offer Price: Determine a fair and competitive price based on the home’s market value and recent comparable sales in the area. Your REALTOR can provide a comparative market analysis (CMA) to help you decide on an appropriate offer price.

- Earnest Money Deposit: This is a deposit made to show your commitment to the purchase. It typically ranges from 1% to 3% of the offer price and is held in escrow until closing.

- Contingencies: Include contingencies to protect your interests, such as financing, inspection, and appraisal contingencies. These allow you to back out of the deal if certain conditions aren’t met.

- Closing Timeline: Propose a realistic closing date that works for both you and the seller. Flexibility can sometimes make your offer more appealing.

2. Understanding the Role of Contingencies

Contingencies are essential safeguards in your offer that allow you to back out or renegotiate if specific conditions aren’t met. Here are the most common contingencies when buying a home in Ohio:

- Financing Contingency: Protects you if your mortgage approval falls through.

- Inspection Contingency: Allows you to negotiate repairs or withdraw your offer if the home inspection reveals significant issues.

- Appraisal Contingency: Ensures the home’s appraised value meets or exceeds the offer price, protecting you from overpaying.

3. Navigating Negotiations

Negotiating the terms of your offer requires strategy and effective communication. Here’s how to navigate this process:

- Initial Offer Submission: Your REALTOR will present your offer to the seller’s agent, who will then relay it to the seller. Be prepared for the seller to counteroffer.

- Counteroffers: If the seller counters, review their proposed changes carefully. Common counteroffers may involve price adjustments, modifications to contingencies, or changes in the closing timeline.

- Negotiation Tactics: Work closely with your REALTOR to develop a negotiation strategy. This may involve being flexible on certain terms while standing firm on others that are non-negotiable for you.

- Effective Communication: Maintain open and respectful communication with the seller throughout the negotiation process. Understanding their motivations can help you craft responses that address their concerns.

4. Finalizing the Agreement

Once you and the seller reach an agreement, the next steps involve formalizing the deal and moving towards closing:

- Review the Contract: Carefully review the purchase agreement to ensure all terms and conditions are accurately reflected.

- Sign the Agreement: Both parties will sign the purchase agreement, and the earnest money deposit will be placed in escrow.

- Prepare for Closing: Begin preparing for closing by arranging for a home inspection, securing final mortgage approval, and coordinating with your REALTOR and lender on required documentation.

5. Practical Tips for Success

- Stay Informed: Keep yourself updated on market conditions and comparable sales in your target area.

- Be Prepared to Act Quickly: In a competitive market, being pre-approved for a mortgage and having your documents ready can help you act swiftly.

- Trust Your REALTOR: Leverage your REALTOR’s expertise and experience to navigate the offer and negotiation process effectively. They can also help you with setting appointments for inspections.

By understanding the components of a competitive offer, including contingencies, and employing effective negotiation strategies, you can successfully navigate this phase of the home-buying process. Working closely with a knowledgeable REALTOR ensures that your interests are protected and that you secure the best possible terms for your new home in Columbus, Ohio.

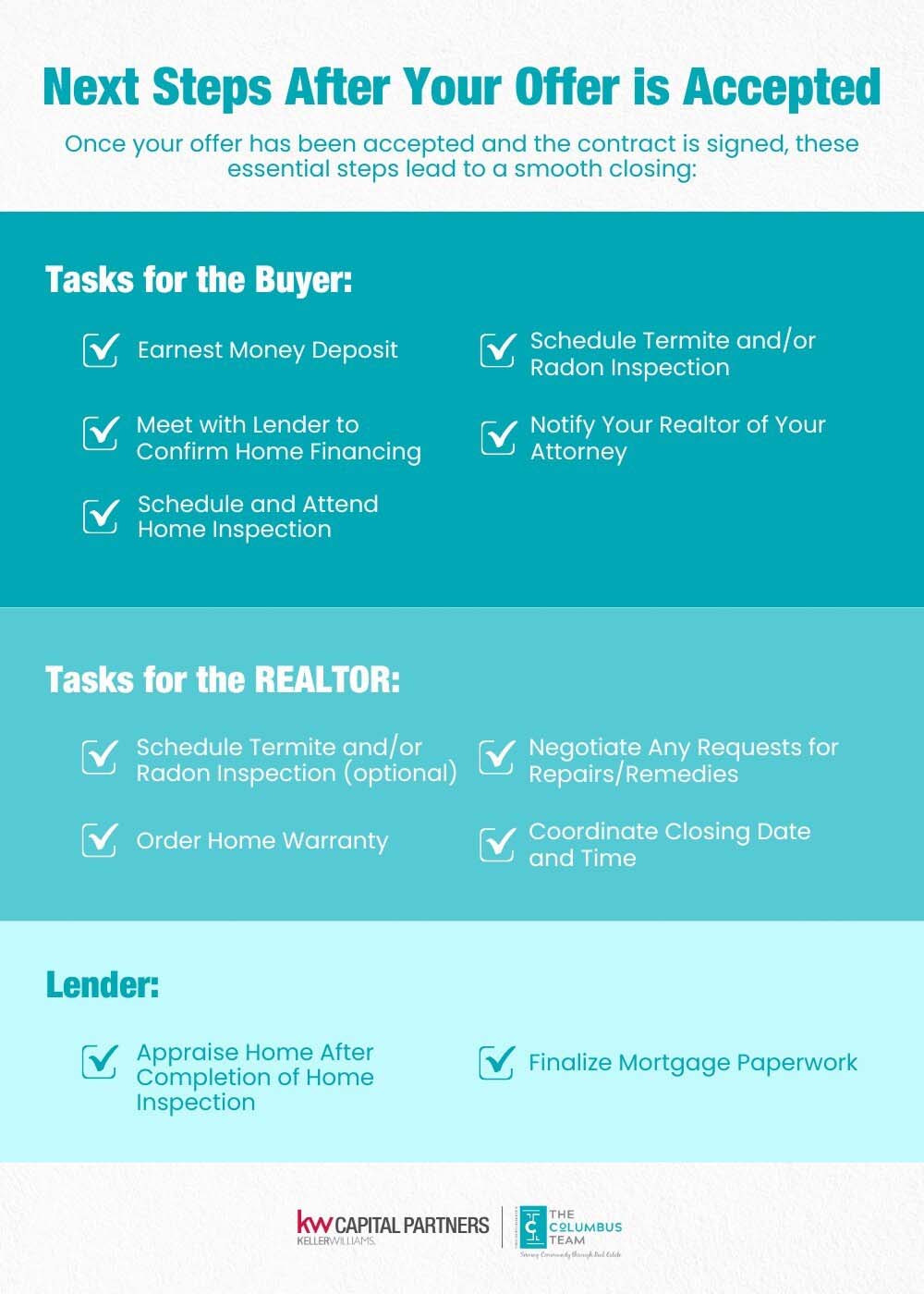

Your Offer Was Accepted! What’s Next?

Congratulations! Your offer was accepted. There’s lots to do before closing but your real estate agent is there for you. This is where having a professional agent really matters. They’ll make sure all details are handled properly and the paperwork is in order. Buying a home in Ohio should be a positive, rewarding experience.

As soon as your offer is accepted, A REALTOR go to work lining up inspections, ordering the home warranty and negotiating for remedies if problems are found. You’ll enjoy peace of mind knowing your REALTOR is on top of the myriad of details.

Home Inspections and Appraisals

Once your offer is accepted, the next major steps are the home inspection and appraisal. These processes ensure that the property is in good condition and valued correctly. At this stage, you might also consider a gas line warranty and a home warranty to protect your investment. Here’s a concise guide to navigating these aspects when buying your home in Ohio:

Importance of Home Inspections

A home inspection is vital for uncovering potential issues that might not be immediately visible, ensuring you’re aware of any necessary repairs before finalizing your purchase. Key components of a home inspection include:

- Structural Elements: Examination of the foundation, roof, walls, windows, and doors.

- Systems and Appliances: Assessment of HVAC, plumbing, electrical systems, water heaters, and major appliances.

- Exterior and Grounds: Check of siding, decks, porches, and landscaping.

- Interior Spaces: Inspection of floors, walls, ceilings, and major fixtures.

- Safety Concerns: Identification of hazards such as faulty wiring, mold, and radon levels.

Additional Inspections

- Radon Testing: Essential in Columbus due to local geology; ensures radon levels are safe.

- Termite Inspection: Checks for signs of termite infestation or damage to the property.

Choosing a Home Inspector

Select a reputable inspector by considering:

- Reputation and Reviews: Seek inspectors with strong feedback.

- Certifications and Experience: Look for certification from ASHI or InterNACHI.

- Sample Reports: Request to see sample inspection reports for detail and thoroughness.

Conducting the Inspection

- Schedule Promptly: Arrange the inspection soon after your offer is accepted.

- Be Present: Attend the inspection to ask questions and understand any issues.

- Review the Report: Carefully review the findings and discuss with your REALTOR whether to request repairs, negotiate the price, or reconsider your offer.

Warranties

- Gas Line Warranty: Covers repairs to gas lines and typically starts at closing, lasting 12 months. Useful in areas with aging gas lines.

- Home Warranty: May cover systems and appliances such as heating/AC, plumbing, electrical, garbage disposal, and more. Coverage varies by insurer, so ask for specifics.

By understanding these key aspects of home inspections, appraisals, and warranties, you’ll be better prepared to make informed decisions and protect your investment in your new home.

Understanding Appraisals: A Key Step in Buying a Home in Ohio

An appraisal is a professional evaluation of a home’s market value, required by lenders to ensure the loan amount does not exceed the property’s value. Here’s a streamlined guide to understanding appraisals and how to navigate the process when buying a home in Ohio:

Key Components of an Appraisal

- Comparable Sales: Appraisers review recent sales of similar homes in the area to determine the market value.

- Property Condition: The home’s overall condition and quality are assessed.

- Location: The value is influenced by the home’s location, including its neighborhood and proximity to amenities.

- Market Trends: Current real estate market conditions are considered.

Choosing an Appraiser

- Lender’s Choice: Usually, the lender selects the appraiser to ensure an unbiased assessment.

- Credentials: Verify that the appraiser is licensed and experienced in the Columbus market.

Navigating the Appraisal Process

- Lender Coordination: Your lender will arrange the appraisal once your offer is accepted.

- Appraisal Report: After the appraisal, you’ll receive a report detailing the home’s value.

- Review and Action: If the appraisal value is lower than the purchase price, discuss options with your REALTOR and lender, which may include renegotiating the price or re-evaluating your financing options.

Addressing Inspection and Appraisal Findings

- Request Repairs or Credits: For significant issues found, request repairs or a credit towards closing costs from the seller.

- Renegotiate the Price: If the appraisal is below the offer price, consider renegotiating with the seller.

- Finalize Your Decision: Use the findings from the inspection and appraisal to make an informed decision about proceeding with the purchase.

Understanding appraisals is another important step to ensuring you make a sound investment when buying a home in Ohio.

Practical Tips for Success during the Inspection and Appraisal Process when Buying a Home in Ohio:

- Stay Informed: Keep open communication with your REALTOR and lender throughout the inspection and appraisal process.

- Be Prepared to Act: Be ready to negotiate or make decisions based on the findings.

- Leverage Professional Advice: Rely on the expertise of your REALTOR and other professionals to guide you through these critical steps.

By thoroughly understanding and effectively navigating the home inspection and appraisal processes, including additional inspections like radon testing and termite inspections, you can ensure that your investment in your new Columbus home is sound and secure. These steps are essential for protecting your interests and making informed decisions.

Understanding Homeowner’s Insurance

Homeowners insurance is vital for protecting your property and personal belongings. Required by lenders and essential for peace of mind, it covers various issues like theft, fire, and vandalism. However, it typically excludes coverage for earthquakes, flooding, power failures, and more. Be sure to choose a policy that fits your needs, considering factors like coverage limits and deductibles. Arrange your insurance at least two weeks before closing to ensure you’re fully protected.

For a more information on setting up homeowners insurance when buying a home in Ohio, read our blog post.

Protecting Your Investment

Purchasing a home is likely the biggest financial investment you’ll make in your lifetime, and it’s essential to take every measure to safeguard that investment. One of the best ways to protect your interests is by hiring a real estate attorney. Although not mandatory, having a legal expert on your side can save you both time and money in the long run.

A real estate attorney’s role is to ensure that all documents are correctly prepared and that your rights are fully protected when buying a home in Ohio. They will meticulously review all key documents, including title records, mortgage agreements, purchase contracts, and transfer documents, to ensure everything is in order. When it’s time to close on your home, your attorney will be there to oversee the process and confirm that everything is completed properly.

If you need recommendations, we have a list of highly-regarded real estate attorneys in the Columbus, Ohio area who have provided exceptional service to our clients in the past. However, if you prefer, you can also seek out a real estate attorney independently.

Closing On Your Home

The big day has finally come. This is the day you’ve waited for and anticipated! You’ll meet with your real estate agent and attorney (if you have one) at the title company to close on the property you’ve purchased. Typically, the seller will be there as well, along with the title company representative. This closing process is the final step to buying your home in Ohio. This phase includes reviewing and signing a series of legal documents that transfer home ownership from the seller to you. Your earnest money will also be returned at this time or it can be applied to your down payment.

Here’s the information you need to navigate the closing process smoothly.

1. Preparing for Closing

Preparation is key to ensuring a seamless closing experience. Here are the steps to take as your closing date approaches:

- Secure Homeowner’s Insurance: You’ll need to have a homeowner’s insurance policy in place before closing. This protects your investment and is typically required by lenders.

- Final Walkthrough: Schedule a final walkthrough of the property 24-48 hours before closing to ensure that the home is in the agreed-upon condition and any repairs requested have been completed.

- Review Closing Disclosure: At least three days before closing, you’ll receive a Closing Disclosure from your lender. This document outlines the final loan terms and closing costs. Review it carefully and ask your lender or REALTOR about any discrepancies or questions.

2. Understanding Closing Costs

Closing costs are fees and expenses you must pay at the closing of a real estate transaction. They typically range from 2% to 5% of the loan amount and can include:

- Loan Origination Fee: Charged by the lender for processing the loan.

- Title Insurance: Protects against potential issues with the title.

- Appraisal Fee: Covers the cost of the home appraisal.

- Home Inspection Fee: Covers the cost of the home inspection.

- Escrow Fees: Charged by the escrow company for managing the closing process.

- Property Taxes and Homeowner’s Insurance: Prepaid costs for property taxes and insurance.

- Recording Fees: Charged by the local government for recording the new deed and mortgage.

- Attorney Fees

- Agent Fees: As of August 2024, homebuyers are now required to sign an agency agreement with their real estate agent, outlining the services provided and the agent’s fees, which are paid directly by the buyer. This replaces the old system where sellers typically covered the commission for both agents. While this new system introduces more transparency and negotiation options, it’s still being adopted, and there may be ongoing adjustments. To ensure you’re getting the most current information and options, please don’t hesitate to reach out to us for guidance on your home purchase.

3. Closing Day: What to Expect When Buying a Home in Ohio

On closing day, you’ll sign the necessary paperwork to finalize your home purchase. Here’s what to expect:

Transfer of Ownership: Once all documents are signed and funds are transferred, the title company will record the new deed with the local government. You’ll then receive the keys to your new home.

Bring Necessary Documents: Ensure you have a valid government-issued photo ID and any other required documents, such as proof of homeowner’s insurance and the Closing Disclosure.

Review and Sign Documents: You’ll review and sign a series of documents, including the deed of trust or mortgage, promissory note, and various disclosures. Take your time to read through each document and ask questions if anything is unclear.

Pay Closing Costs: You’ll need to bring a cashier’s check or arrange a wire transfer for the closing costs and down payment. Your Closing Disclosure will specify the exact amount needed.

4. After Closing: Final Steps to Buying a Home in Ohio

Even after closing, there are a few additional steps to ensure everything is in order:

- Store Important Documents: Keep all closing documents in a safe place, including the deed, Closing Disclosure, and any warranties or manuals provided by the seller.

- Set Up Utilities: Arrange for the transfer of utilities into your name, including electricity, water, gas, and internet.

- Change of Address: Update your address with the postal service, banks, credit card companies, and any other relevant organizations.

- Home Security: Consider changing the locks and setting up a security system for added peace of mind.

Practical Tips for Success:

- Stay Organized: Keep track of all documents and communications related to the closing process.

- Ask Questions: Don’t hesitate to ask your REALTOR, lender, or closing agent about any part of the process that you don’t understand.

- Prepare for Moving Day: Plan your move carefully, ensuring you have all the necessary supplies and assistance to make the transition smooth.

By understanding and effectively navigating the closing process, you can ensure a smooth transition into your new Ohio home. This final step is essential for securing your investment and starting your new journey as a homeowner.

Moving Into Your New Home in Ohio

Congratulations on closing on your new home in Columbus, Ohio! Moving in is an exciting milestone, but it can also feel overwhelming. That’s why we’ve put together a collection of helpful resources to make your transition as smooth as possible. From expert moving tips to strategies for keeping little ones and pets stress-free during the process, we’ve got you covered. Check out our tips and tricks for moving after buying a home in Ohio, moving with kids and pets, tips for moving during the school year, and relocating with pets to help you settle in with ease.

FAQ – Frequently Asked Questions

This section addresses frequently asked questions questions about buying a home in Columbus, Ohio, offering clear, concise answers to help you on your journey. They address common concerns and provide quick, helpful insights:

What is the first step in buying a home in Columbus, Ohio?

The first step in buying a home in Columbus, Ohio, is getting pre-approved for a mortgage. This helps you understand your budget and strengthens your position as a buyer. Pre-approval involves submitting financial documents to a lender, who will then determine the loan amount you qualify for. This step is crucial before you start looking at homes, as it provides clarity on what you can afford and shows sellers that you are a serious buyer.

How do I find a reputable real estate agent in Columbus?

Finding a reputable real estate agent in Columbus involves a few key steps:

Interviews: Interview multiple agents to find someone you feel comfortable with and who understands your needs. Ask about their approach to helping clients find homes, their communication style, and their availability.

Research and Referrals: Start by asking friends, family, and colleagues for recommendations. Look for agents with positive reviews and a strong online presence.

Experience and Expertise: Choose an agent with extensive experience in the Columbus market. They should be knowledgeable about local neighborhoods, market trends, and the home-buying process.

What should I look for during home inspections?

During a home inspection, pay attention to the following areas:

Structural Elements: Check the foundation, roof, walls, windows, and doors for any signs of damage or wear.

Systems and Appliances: Ensure the HVAC system, plumbing, electrical systems, water heaters, and major appliances are in good working condition.

Exterior and Grounds: Inspect the exterior of the home, including siding, decks, porches, and landscaping.

Interior Spaces: Look for issues in floors, walls, ceilings, and major fixtures in bathrooms and kitchens.

Safety Concerns: Identify any potential safety hazards, such as faulty wiring, mold, and radon levels.

How much should I save for a down payment?

Ideally, you should save at least 20% of the home’s purchase price for a down payment. This helps you avoid private mortgage insurance (PMI) and can result in better loan terms. However, there are loan programs available that require lower down payments, such as FHA loans (3.5%), VA loans (0% for eligible veterans), and USDA loans (0% for rural properties). Consult with your lender to determine the best option for your financial situation.

Are there any first-time homebuyer programs in Columbus, Ohio?

Yes, there are several programs available for first-time homebuyers in Columbus, Ohio:

USDA Loans: Available for properties in eligible rural areas with no down payment required.

Ohio Housing Finance Agency (OHFA): Offers down payment assistance, reduced interest rates, and mortgage tax credits for first-time homebuyers.

Federal Housing Administration (FHA) Loans: Provide lower down payment options and more flexible credit requirements.

Veterans Affairs (VA) Loans: Offer no down payment options and competitive interest rates for eligible veterans and active-duty service members.

How long does the buying process take in Columbus?

On average, the home-buying process in Columbus takes 30-60 days from offer acceptance to closing. This timeline can vary depending on factors such as financing, inspections, and negotiations. Here’s a general breakdown of the timeline:

Finalizing Financing and Closing: 30-45 days

Mortgage Pre-Approval: 1-2 weeks

Home Search: Varies (can take a few weeks to several months)

Offer and Negotiation: 1-2 weeks

Home Inspection and Appraisal: 1-2 weeks

What are closing costs, and how much should I expect to pay?

Closing costs are fees and expenses you must pay at the closing of a real estate transaction. They typically range from 2% to 5% of the loan amount and can include:

Recording Fees: Charged by the local government for recording the new deed and mortgage.

Loan Origination Fee: Charged by the lender for processing the loan.

Title Insurance: Protects against potential issues with the title.

Appraisal Fee: Covers the cost of the home appraisal.

Home Inspection Fee: Covers the cost of the home inspection.

Escrow Fees: Charged by the escrow company for managing the closing process.

Property Taxes and Homeowner’s Insurance: Prepaid costs for property taxes and insurance.

Can I negotiate the price of a home in Columbus?

Yes, price negotiations are common in real estate transactions. Here are some tips for successful negotiation:

Communication: Maintain open and respectful communication with the seller. Understanding their motivations can help you craft offers that address their needs while protecting your interests.

Market Research: Use a comparative market analysis (CMA) provided by your REALTOR to understand the home’s market value.

Offer Terms: Consider including contingencies in your offer, such as financing, inspection, and appraisal contingencies, to protect your interests.

By addressing these common questions, you can navigate the home-buying process in Columbus with confidence. Whether you’re a first-time homebuyer or an experienced investor, understanding these key aspects will help ensure a smooth and successful transaction.

We hope that our Ultimate Guide to Buying a Home in Columbus Ohio, has provided you with valuable insights and information to assist you on your home-buying journey. If you found this guide helpful or if there are any additional questions or topics you would like us to cover, please let us know. Your feedback is essential in helping us improve our resources.

Wishing you a smooth and successful home-buying experience, and we look forward to the opportunity to assist you in finding your dream home in Columbus. As your trusted REALTORs, we are here to guide you every step of the way and ensure that you find the perfect home that meets your needs and preferences.

For any further assistance or to begin your home search, don’t hesitate to contact us. We are excited to help you embark on this new chapter in Columbus, Ohio.